Your assets have never had so much Values!

MyAssetRocks turns your tangible assets into profits!

They support us

Why should you use MyAssetRocks?

Can you imagine having employees who only work 30% of their time? Or selling only 30% of your inventory? Or earning interest on only 30% of your investments? Of course not!

And yet, your tangible assets are only used between 30% and 70% of their capacity!

What a waste, isn't it? Waste of value, waste for your company, waste for your ecosystem and waste for the environment!

How does it work?

01.

Optimize

your internal management

Decentralize the management of your assets by giving each of your employees and departments a real-time view of what the company has, what is available at any given time, and its operating status. Each use is then planned for an improved rate of service.

You can also access consolidated and dynamic dashboards, and benefit from all the performance indicators you need for optimized asset management.

02.

Access to new opportunities

You know exactly when an asset is or will be used, so you also know when it's not! And what happens when it's not in use?

With MyAssetRocks, you can easily rent it out to other subsidiaries, partners or the market. Increase your utilization rates and generate additional cash flow!

03.

Control your environmental footprint

By applying the principles of the circular economy, the collaborative economy and the economy of functionality, you gain access to levers for environmental optimization!

Use the environmental dashboard to calculate the environmental footprint of each of your assets and the gains generated by renting them out.

A platform designed by you and made for you

We understand the specific needs of your business, and MyAssetRock has been designed to meet them.

Fully customizable

Define the role of each member of your team

Define the visibility of each of your assets

Define rental terms for each of your assets

Generating just 5% additional profitability on your assets means:

18%

Your customer receivables covered

18%

Your total payroll covered

25%

Your working capital covered

And all without having to invest, just by increasing the profitability of what you already have!

A true end-to-end asset management platform,

MyAssetRocks gives you 360° control of your assets

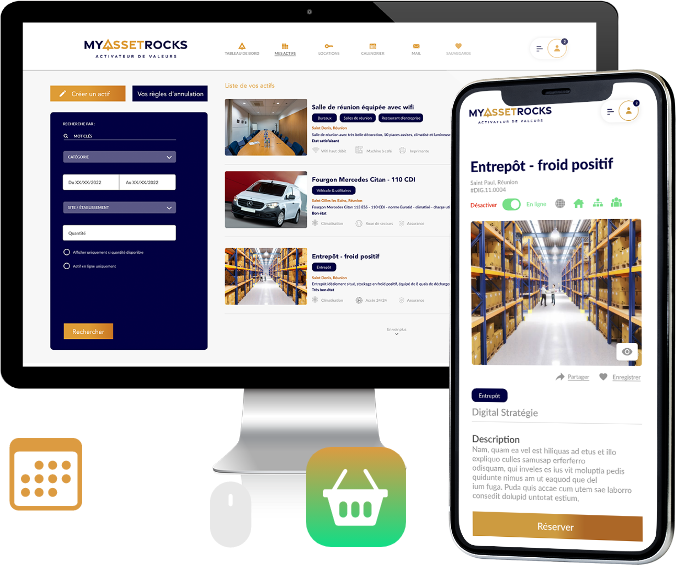

Access all your assets in just 1 click

Whether you want to search for an asset, check its usage schedule, check its availability or book it, you can do it at your fingertips.

Get the assets you need

Get the assets you need

Need a temporary asset? A machinery, storage space, laboratory equipment or office space?

Search easily on our marketplace and access, in a geolocalized way, the assets of your subsidiaries, your partners or the market.

Don't let your assets rest, rent them out

When an asset is not in use, whether for 1 hour or several months, rent it out!

Don't lose money, make money! Boost your profitability and cash flow generation

Base your decisions on reliable and accurate data

Base your decisions on reliable and accurate data

Access operational, financial and environmental dashboards.

Whether you want an asset-by-asset view, by asset category, by assignment center, by site, by employee or globally, MyAssetRocks will provide you with the information you need.

MyAssetRocks optimizes your assets for...

They testify

Do you have any questions? Let's talk.

We'd love to have a 1:1 chat with you to explain exactly how MyAssetRocks can unlock the potential of your tangible assets.

Book a demo